TUESDAY, OCTOBER 21, 2025

What’s in a Retainer – Ethics (12:00 pm-1:00 pm) ET

Location: Talbot A-D

What’s in a Retainer (Ethics) – Anthony Duckett, Moderator; Hugh Berkson, Mary Curry, Elliot Rosenberger. This session will discuss the unique challenges that come with generating an effective retainer agreement in our area of law. We will discuss different clauses that you can place in your agreement as well as different phrasings of certain common retainer agreement sections that will help ensure that you, your practice, and your client are protected.

Strategies for Drafting an Effective Statement of Claim in Arbitration (1:05 pm-2:05 pm) PT

Location: Talbot A-D

Strategies for Drafting an Effective Statement of Claim in Arbitration – Samuel Edwards, Moderator; Barry Bordetsky, Montgomery Griffin. In this session a Panel of attorneys and an industry expert will discuss how to bring and prosecute successful claims against Registered Investment Advisors. The ever-changing procedural landscape makes filing RIA cases difficult. This Panel will discuss some basics about filing a case in state or federal court and how to use court-litigation to force your RIA into submission. Many RIAs use AAA or JAMs clauses in their arbitration agreements, and each of those forums offers both opportunities and pitfalls that can derail practitioners who are not familiar with those rules. Last, the Panel will discuss how to frame your pleading and causes of action no matter what forum you are in and how to leverage discovery to your advantage.

Damages (2:15 pm – 3:15 pm) ET

Location: Talbot A-D

Damages – Lance McCardle, Moderator; Brian Henderson. Everything you need to know about damages in FINRA Arbitrations: types of remedies, how to calculate various measures of damages, pros and cons of different state statutes, and more…”

Coffee Break (3:00 pm – 3:30 pm) ET

Location: Talbot D Foyer

Motions in FINRA Arbitration (3:20 pm – 4:20 pm) ET

Location: Talbot A-D

Motions in FINRA Arbitration – Jason Doss, Moderator; David Robbins, Richard Frankowski, Benjamin Biard, David Jonson. This session will have leading PIABA experts walk attendees through motion practice in FINRA and AAA arbitration forums. Attendees will learn best practices for motions.

How to Bring a Selling Away Case (4:35 pm – 5:35 pm) ET

Location: Talbot A-D

How to Bring a Selling Away Case – Jaime Scivley, Moderator; Sander Ressler, William Thompson. Join this experienced Panel for the “nuts and bolts” of bringing selling away claims against Broker Dealers. In virtually every defense, a Broker Dealer seeks to shield itself from selling away or other fraudulent behavior claiming the conduct occurred “outside” its purview and control. This blanket assertion is false. In this session, attorneys, FINRA Enforcement, and an industry expert will discuss a Broker Dealer’s duties and liabilities with respect to selling away, outside business activities, and fraudulent schemes. The Panel will identify common failures in supervision and compliance and the evidence necessary to try a successful case. To the same end, the Panel will discuss industry best practices to protect customers. And the Panel will highlight recent enforcement actions and regulatory exam priorities in this area.

New Member Welcome Reception (5:30 pm – 7:00 pm) ET

Location: Ocean Front Lawn

WEDNESDAY, OCTOBER 22, 2025

Registration (8:00 am – 5:30 pm) ET

Location: Talbot Registration Desk

Breakfast (7:30 am – 9:00 am) ET

Location: Talbot Colonnade

Updates with FINRA (9:00 am – 10:00 am) ET

Location: Talbot A-D

Updates with FINRA – Adam Gana, Moderator; Richard Berry, Todd Saltzman, Carolann Gemski, Sarah Gill. Learn the current status of FINRA Dispute Resolution directly from FINRA senior staff. This panel will provide PIABA members with the opportunity to get first hand answers to their issues in FINRA arbitration.

Coffee Break (9:45 am – 10:15 am) ET

Location: Talbot Foyer

Protecting Senior Investors: Rules, Regulations, and Firms Responsibilities in Detecting and Preventing Fraud (10:15 am- 11:15 am) ET

Location: Talbot A-D

Protecting Senior Investors: Rules, Regulations, and Firms Responsibilities in Detecting and Preventing Fraud – Courtney Werning, Moderator, Catherine Mustico, Lori Schock, Clark Flynt-Barr. This session will explore the evolving legal and regulatory framework governing how brokerage firms and investment advisers must identify and respond to financial exploitation of elderly clients. We will examine the duties imposed by FINRA rules, SEC guidance, and state regulations, including obligations to supervise accounts, investigate red flags, and take protective action when elder fraud is suspected. Panelists will discuss the use of trusted contacts, temporary holds, internal compliance protocols, and recent enforcement trends. Attendees will gain practical insights into how to plead these cases and what to look for in discovery.

Emotional Distress Claims: How to Present Non-Economic Damages (11:30 am – 12:30 pm) ET

Location: Talbot A-D

Emotional Distress Claims: How to Present Non-Economic Damages– Jonathan Furgison, Moderator; Brandon Reif, Adam Weinstein. This session will explore strategies for effectively presenting non-economic damages, including emotional distress, anxiety, and loss of trust—harms that often outweigh the economic losses themselves. Attendees will learn how to build compelling narratives, use corroborating evidence, and frame emotional harm in ways that resonate with arbitrators and deliver real justice for investor victims.

Boxed Lunch (12:0 pm – 1:00 pm) ET

Location: Talbot Colonnade

Membership Meeting (12:45 pm – 1:45 pm) ET

Location: Talbot A-D

The Art of Arbitrator Ranking (1:45 pm – 2:45 pm) ET

Location: Talbot A-D

The Art of Arbitrator Ranking – Michael Bixby, Moderator; Stefan Apotheker, Matthew Wolper, Mike Yan. Arbitrator ranking is an art, not a science. But not all art is created equal. An unfair or biased arbitration panel is the death knell for any case, no matter how meritorious or sympathetic your client. This session will cover advanced arbitrator ranking techniques, tips, tools, and resources for arbitrator research, ranking and selection. You’ve read the arbitrator disclosure report, now what? This Panel will explore best practices for analyzing arbitrator award history, connections, potential worldviews, and taking information and research from drinking out of a fire hydrant to submitting the ranking to help you secure the best arbitration panel possible.

Marketing Ethics (1:45 pm – 2:45 pm) ET

Location: Talbot F-H

Marketing Ethics – David Neuman, Moderator; Philip Vujanov, Jorge Altamirano, Jonathan Grabb. We all use various tools to try to market ourselves and bring in more cases. This seminar will explore how to comply with ethical rules and requirements when marketing. Our panelists will discuss how these rules fit in with websites, blogging, cease-and-desist letters, solicitation letters, and others.

Coffee Break (2:45 pm – 3:15 pm) ET

Location: Talbot Foyer Cumberland

Leveling the Playing Field. How to File and Run a Mass Action (3:00 pm – 4:00 pm) ET

Location: Talbot A-D

Leveling the Playing Field. How to File and Run a Mass Action – Joseph Peiffer, Moderator; Peter Mougey, Robert Rikard. This session will walk you through how to take a case from a single plaintiff to a mass action and win.

Annuities (3:00 pm – 4:00 pm) ET

Location: Talbot F-H

Annuities – Melinda Steuer, Moderator; William Young, Jason Berkowitz. This panel will focus the terms, features, and suitability of the different types of annuity products (variable, fixed and indexed), the regulatory framework and applicable regulations for the different types of annuity products, and identifying actionable and non-actionable issues for evaluating annuity cases.

Brokerage Document Forgeries and Manipulation: Destroying the Respondent’s Case (4:15 pm – 5:15 pm) ET

Location: Talbot A-D

Brokerage Document Forgeries and Manipulation: Destroying the Respondent’s Case – Thomas Ajamie, Moderator; Jason Kane, John Osborne. This panel will explain forgeries and false documentation by brokerages and financial advisors that are found in many cases-if you know where to look and how to identify them. Once you do, your case will take on powerful evidence that will likely persuade the arbitration panel to rule for your client. Arbitrators punish forgeries, false documents, and manipulated information. Give your case this added fuel to drive it to victory.

Beyond Broker Check – Uncovering U4, U5 & CRD Report Treasures (4:15 pm – 5:15 pm) ET

Location: Talbot F-H

Beyond Broker Check – Uncovering U4, U5 & CRD Report Treasures –Kimberly Chavers, Moderator; Eric Siber. From Internal Review to Termination to Customer Dispute to Financial disclosures, CRD Reports, Form U4s & U5s can often be a treasure map to fruitful discovery you’ve never thought to seek – or a pot of gold to boost your case. We’re going beyond BrokerCheck to cover how to obtain these reports & uniform form filings pre-discovery and even before you file a Statement of Claim to identify additional, potential claims, what to look for, how to interpret these documents, and how to use them, including HOW TO: Get all the dirt on disclosures in discovery,

Spot hidden red flags & liability that are often missed, Identify valuable witnesses, Cross-examine opposing experts & use a CRD Report during voir dire, and even Find additional Claimant Clients! BONUS: BrokerCheck & CRDs aren’t just for “bad brokers”. Hear how a CRD Report exposed a widely used opposing expert who you will not find on BrokerCheck!

Women’s Happy Hour (5:30 pm – 6:45 pm) ET

Location: Colonnade

Welcome Reception (7:00 pm – 9:00 pm) ET

Location: Courtyard

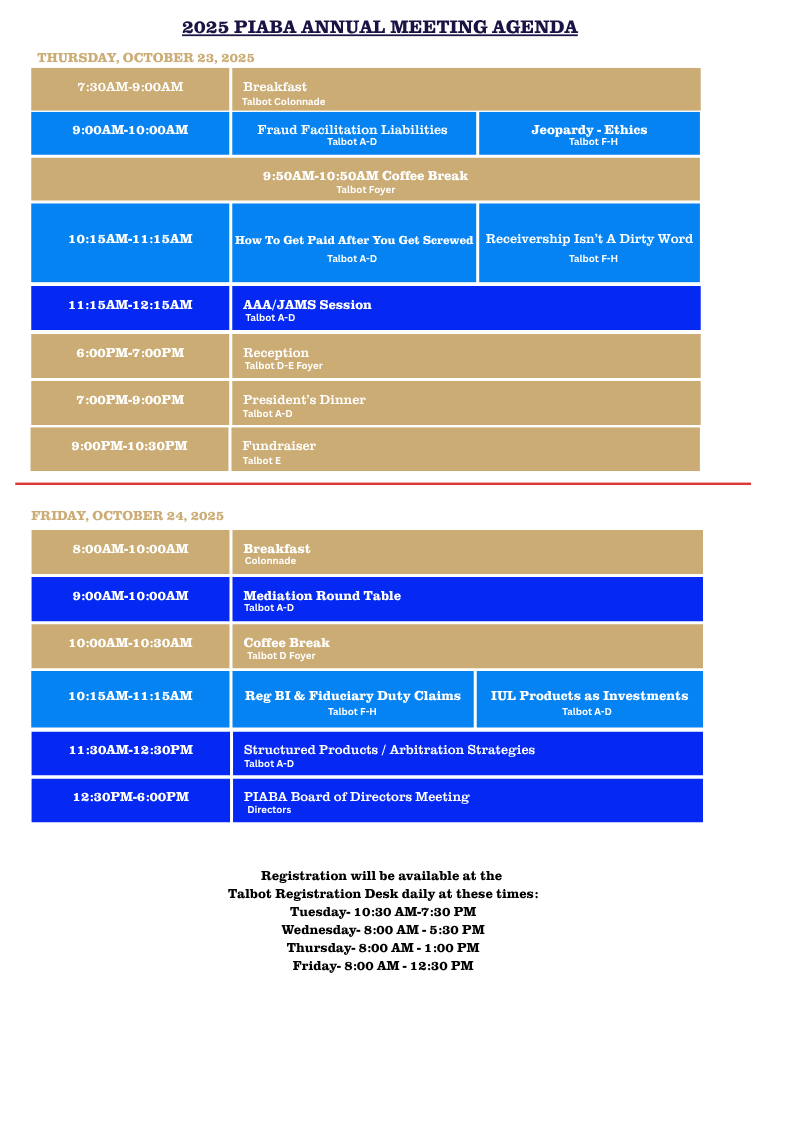

THURSDAY, OCTOBER 23, 2025

Registration (8:00 am – 1:00 pm) ET

Location: Talbot Registration Desk

Breakfast (7:30 am – 9:00 am) ET

Location: Talbot Colonnade

Fraud Facilitation Liability (9:00 am – 10:00 am) ET

Location: Talbot A-D

Fraud Facilitation Liability – Benjamin Edwards, Moderator; Sander Ressler, Mike Evans, Marni Gibson. This panel discusses financial adviser liability for frauds and scams targeting investor assets. It evaluates the structure for liability under fiduciary liability, equitable principles, or other grounds.

Jeopardy Ethics (9:00 am – 10:00 am) ET

Location: Talbot F-H

Jeopardy Ethics – Jason Kane, Moderator; Craig Kuglar. This Continuing Legal Education presentation will explore key areas of legal ethics through an interactive “Jeopardy” style format. The session is designed to engage participants in a review of current ethical principles and practical application. Topics covered will include analysis of recent ethics opinions and scenario-based questions.

Coffee Break (9:50 am – 10:20 am) ET

Location: Talbot Foyer

Receivership Isn’t a Dirty Word (10:15 am – 11:15 am) ET

Location: Talbot F-H

Receivership Isn’t a Dirty Word – Hugh Berkson, Moderator; Kathy Bazoian Phelps, Mark Dottore. All too often, the appointment of a receiver is perceived to be the death knell for an individual interested in pursuing a claim.Nothing could be further from the truth. Join us for a session in which seasoned receivers share how PIABA members can work with them for everyone’s benefit. We’ll share tips and tricks, and potential landmines to avoid.

How to Get Paid After You Get Screwed (10:15 am – 11:15 am) ET

Location: Talbot A-D

How to Get Paid After You Get Screwed – Scott Silver, Moderator; Daniel Centner, Aaron Cohn. The majority of customer arbitration claims stem from the sale of private placements and other illiquid securities. Far to often, we see small firms that go out of business after these products collapse and the principals scatter to new firms leaving investors with unpaid arbitration awards and settlements. This panel will dive into the practical ways that investors can recover fair compensation including an in depth discussion about maximizing recoveries from insurance companies, control persons and financial advisors both pre and post award.

Navigating the Procedural Rules of the AAA and JAMS – A Primer on Understanding the Process Better than Your Opponent (11:30 am – 12:30 pm) ET

Location: Talbot A-D

Navigating the Procedural Rules of the AAA and JAMS – A Primer on Understanding the Process Better than Your Opponent – Joseph Wojciechowski, Moderator; Sara Hanley, Brandon Reif, Robert Cornish. In this session, experienced ADR practitioners will discuss the procedural rules in the AAA and JAMS. Of particular note, the Panel will discuss the changes to the AAA Consumer Rules, for better and worse. The Panel will also delve into the JAMS Comprehensive Rules and discuss the AAA commercial rules in the context of taking advantage of what is offered and the importance of making sure your arbitrator understands the discretion these rules offer. If time permits, the Panel will touch on the new proposed Securities Rules for the AAA.

Reception (6:00 pm – 7:00 pm) ET

Location: Talbot D-E Foyer

President’s Dinner (7:00 pm – 9:00 pm) ET

Location: Talbot A-D

Fundraiser (9:00 pm – 10:30 pm) ET

Location: Talbot E

FRIDAY, OCTOBER 24, 2025

Registration (8:00 am – 12:30 pm) ET

Location: Talbot Registration Desk

Breakfast (8:00 am – 10:00 am) ET

Location: Colonnade

Mediation Round Table (9:00 am – 10:00 am) ET

Location: Talbot A-D

Mediation Round Table – W. Scott Greco, Moderator; Jeffrey Erez, Sean Coughlin, Howard Tescher, Jeffrey Grubman. Join us for an engaging session exploring thorny issues in mediations, where experienced panelists – a seasoned mediator, a Claimant’s counsel, and a Respondent’s counsel – offer practical insights from their unique perspectives. The panel will delve into challenges such as impasse-breaking strategies, disagreements on facts, law, or damages, unrealistic expectations, and ethical considerations that often arise during mediation.

Coffee Break (10:00 am – 10:30 am) ET

Location: Talbot D Foyer

Reg BI and Fiduciary Duty Claims (10:15 am – 11:15 am) ET

Location: Talbot F-H

Reg BI and Fiduciary Duty Claims – Ryan Cook, Moderator; Sean Sweeney, Courtney Werning, Erik Frias. Discussing uses and potential differences between handling suitability claims and claims covered by Regulation Best Interest or other fiduciary standards.

IUL Products as Investments??? Misrepresentation, Suitability, and the Regulatory Gap in Indexed Universal Life Policies (10:15 am – 11:15 am) ET

Location: Talbot A-D

IUL Products as Investments??? Misrepresentation, Suitability, and the Regulatory Gap in Indexed Universal Life Policies – Robert Rikard, Moderator; William Boersma. This talk will expose how Indexed Universal Life (IUL) policies are sold as safe, tax-free retirement investments, but in reality, are complex, high-cost insurance products that often implode. We’ll cover how these products are misrepresented, why they’re rarely suitable, and how the regulatory system is failing the investors we represent.

Structured Products – Arbitration Strategies (11:30 am – 12:30 pm) ET

Location: Talbot A-D

Structured Products – Arbitration Strategies – Jeffrey Erez, Moderator; Craig McCann, Susan Song. This session will focus on the essential elements to prevail against a brokerage firm in a claim based on structured products. The session will highlight the unique characteristics of structured notes which are considered complex products in the securities industry. Due to their complexity, these securities are ripe for sales practice abuses. We will explore the types of typical abuses and how they translate into rules violations as well as how to prove up common law and statutory claims based on such violations. Finally, we will explore the various damages models available as remedies for losses in structured notes.

Download Session Materials

PIABA Board of Directors Meeting (12:30 pm – 6:00 pm) ET

Location: Directors